What Is The Ideal P/e Ratio

Learn what is a PE Ratio ie Price to Earnings ratio and why does it matter when doing a fundamental analysis of a stock industry or the whole stock marke. The Price Earnings Ratio PE Ratio is the relationship between a companys stock price and earnings per share EPS.

Price To Earnings Ratio Pe Ratio Definition

At first glance a high PE ratio suggests that investors believe it has high growth potential whereas a low PE ratio would indicate that growth is expected to be slow or non-existent.

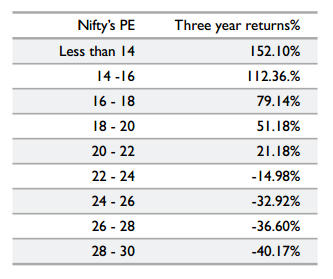

What is the ideal p/e ratio. 98 rows Current PE. Earnings per share EPS is the amount of a companys profit allocated to each. It is considered to be in oversold range when Nifty PE value is below 14 and its considered to be in overvalued.

The PE ratio of the broad Australian share market has for the most part. The PE ratio is calculated by dividing the market value price per share by the companys earnings per share. Analysts and investors can consider earnings from different periods for the calculation of this ratio.

Aggregate Mkt Cap Net Income all firms Aggregate. The PE ratio or price-to-earnings ratio is a quick way to see if a stock is undervalued or overvalued and generally speaking the lower the PE ratio is the better it is for the business and for potential investors. It represents the price an investor pays to buy 1 of the earnings of a company.

It is calculated by dividing the current market price CMP of stock by profitearnings per share EPS. Historical PE ratios vary from sector to sector and over time. PE ratio share priceearnings per share.

PE ratio is the most widely used parameter to analyse whether the stock of any company is overvalued or undervalued at any point in time. PE Ratios by Sector Each industry has a distinct PE range that is normal for that group. Say Teslas EPS is 133 and its share price is trading at 686 this would give TSLA a PE ratio of 51578.

Essentially a PE ratio reflects the earnings potential of a company in the eyes of investors. This equation looks like. For instance Fidelity research in early 2021 pegged the average health care companys PE ratio at nearly 70.

In 2008 the Nifty PE surged above the 28 mark. A low PE is generally considered better than a high PE. On the other hand in the banking sector companies tended to have a PE ratio of just under 115.

For the SP 500 is between 13 and 15. The Price to Earnings or PE ratio is one of the most basic ways to try and figure out if a stock is generally cheap. The average PE ratio will depend on the benchmark youre using to compare a stock to.

The PE ratio of a fund is the weighted average of the PE ratios of the stocks in a funds portfolio. However the most commonly used variable is the earnings of a company from the last 12 months or one year. The metric is the stock price of a company divided by its earnings per share.

The equation for the PE ratio is simply Price Earnings. The logic behind the PE ratio is quite simple. PE Ratio or Price to Earnings Ratio is the ratio of the current price of a companys share in relation to its earnings per share EPS.

While the average trailing 12-month PE for the FTSE 100 is 1755 as of December 2020. You calculate the PE ratio by dividing the market value of a share by the companys earnings per share.

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

Nifty P E Ratio Price Book Ratio Dividend Yield Chart

Pe Ratio Price To Earnings Ratio Types Formula And Limitations Of Pe Ratio

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

5 Financial Ratios Every Stock Investor Should Know

Price To Earnings P E Ratio Definition And Examples

What Is A Good Pe Ratio For A Stock Is A High P E Ratio Good Historical Pe Ratios

Low Pe Stocks In India 2021 What Is The Significance Of Low Pe Getmoneyrich

Posting Komentar untuk "What Is The Ideal P/e Ratio"